|

How Empires Fall

The Battle of Bretton Woods by Benn Steil. Princeton University Press, 2013, $29.95.

At the time of the great economic crisis of 2008, some world leaders, as is their wont at such moments, called for a complete rethinking of the world financial system. The name of 'Bretton Woods,' a small and remote New Hampshire town where representatives of forty-four nations convened in 1944, was invoked as a successful example of where a global monetary system was designed ensuring the robust economic growth of the 1950s and 60s. This book is the story of how that conference came about, what happened during the conference and how the Bretton Woods system came to an end in 1971. But it's about more than that. The subtitle of this book is "John Maynard Keynes, Harry Dexter White, and the Making of the New World Order" and central to the book are the characters and actions of White and Keynes, the two economists who largely represented American and British interests at the conference. But the book is about even more than that. It covers the precipitous fall of one great power and the rapid rise of another. At the beginning of the First World War, British national debt had been steadily falling for a century to reach almost 25 per cent of gross domestic product. By the end of the Second World War it had risen to almost 250 per cent, the level it was at the end of the Napoleonic wars. Britain was, to quote Keynes, facing a 'financial Dunkirk.' Lord Halifax, Britain's ambassador in the U.S. reportedly once whispered to Keynes about the Americans, "It's true they have the money bags but we have all the brains." Was Halifax merely flattering Keynes, the first international celebrity economist, sent to America as Britain's final, greatest and most persuasive economic beggar? If so, it did not take long for Halifax to learn whether it was to be the brains of Keynes or American moneybags which would carry the most weight in the designing of the new world order. Benn Steil is both an economist and an entertaining writer. He devotes chapters to both Keynes and White. On Keynes, Steil wisely steers clear of the Bloomsbury Set fluff and sticks to the economics. Keynes published his first book, Indian Currency and Finance in 1913. According to Steil, two ideas emerged which were to be constants in the thought of Keynes: the diminution of the role of gold and London as the natural and pre-eminent financial centre of the world.

John Maynard Keynes represented Britain at both Versailles and Bretton Woods

On gold Keynes was adamant. When people insisted that a reserve currency need take the form of a physical commodity, they were backing, "a relic of a time when governments were less trustworthy in these matters than they are now" (p. 64). Keynes's criticism of the gold standard was to grow rapidly, and already in 1914 in an Economic Journal article, he wrote in characteristic style that if "gold is at last deposed from its despotic control over us and reduced to the position of a constitutional monarch, a new chapter of history will have opened. Man will have made another step forward in the attainment of self-government." (p. 65). But 1914 was also to be the year that the fond assumptions of the British establishment about London as a financial centre and the pound sterling were to be called into question. Before WW1, half the world's trade was financed through British credit. By 1918, the question was already being posed as to whether Britain could ever reclaim her predominant 19th century economic position. Nevertheless, the pre-1914 Keynes remained wedded to some 'old orthodoxies'. He thought that "falling prices were better than rising ones because the former benefited wage earners and creditors over entrepreneurs and debtors: this led to a more equal distribution of wealth, he said, and was therefore more just." (p. 65) He was also Secretary of the Cambridge University Free Trade Association and thought that the community as a whole could not hope to gain by making artificially scarce what the country wanted. What a dull young fellow he was! Keynes left Cambridge to join the Treasury in January 1915. As long as Keynes worked there, he was exempted from military service. He nevertheless, lodged an official conscientious objection in February 1916 on the grounds that conscription violated his freedom of choice. Steil speculates as to why Keynes did this. Keynes was under considerable personal pressure from Bloomsbury friends such as Duncan Grant and Lytton Strachey and other colleagues such as Bertrand Russell and D.H. Lawrence to resign his Treasury position and oppose the war. "The conscientious objection application was, by all appearances, an insurance policy to cover himself if he lost his Treasury exemption through resignation." (p. 66) But let us not exclude the possibility that Keynes was a genuine Classical Liberal in some matters and believed that conscription, even in wartime, was a moral wrong. After the defeat of Germany in November 1918, Keynes stayed on at the Treasury and attended the Versailles Peace Conference. He resigned in "misery and rage" three weeks before the signing of the final treaty on June 28th, 1919. A few months later, he would become a public figure when he published The Economic Consequences of the Peace, a devastating economic critique of the Versailles Treaty. In light of the later views of Keynes, much of this excellent book has a tinge of irony for this Classical Liberal. Keynes looks at the development of the European economy since 1870 to 1914 and notes the benefits of economic integration. He particularly points out that "the various currencies, which were all maintained on a stable basis in relation to gold and to one another, facilitated the easy flow of capital and of trade to an extent the full value of which we only realise now, when we are deprived of its advantages." (p. 72) Keynes also noted that, "the immense accumulations of fixed capital which, to the great benefits of mankind, were built up during the half century before the war, could never have come about in a Society where wealth was divided equally." (p. 72) Keynes saw that the Great War was a massive and undesirable hiatus in European economic development and that normal service should be resumed as soon as possible. Germany, if it "is to be 'milked'... must not first of all be ruined." (p. 72) Instead, a vast and cumbersome arrangement of reparations was designed which would carry on the Great War by peaceful means and prolong economic dislocations into the post-war period.

The big four politicians at Versailles are amused. They are, from left to right, Lloyd George (UK), Orlando (Italy), Clemenceau(France) and Wilson (U.S.A)

As Norman Angell pointed out in his book The Great Illusion, published before the war,“ The difficulty in the case of a large indemnity is not so much the payment by the vanquished as the receiving by the victor.” Getting another nation’s goods is not a problem in the modern world. It is more important to maintain the smooth workings of the world markets by which goods are freely available. Indemnities and military tributes tend to dislocate these very markets and Keynes, to his credit, was well aware of this fact. After the war, the main object of Keynes's ire was the Bank of England which, through interest rises, was exerting downward pressure on prices in order to make possible the restoration of the pre-war dollar-sterling parity of $4.86. Keynes attacked the bank's belief that wages were sufficiently flexible to bring about the desired outcome and said the government should let "the dollar exchange go hang." (p. 74) In a lecture at the National Liberal Club in 1923, he said, "The more troublous the times, the worse does a laissez-faire system work." Yet he offered no revolutionary insights as to why this might be so. Keynes's first major attempt to do this came in his December 1923 work, A Tract on Monetary Reform. Milton Friedman thought that this was Keynes's best book. The main theoretical argument of the work is that it is the demand for money, rather than its supply, that the monetary authorities should aim to stabilise. They needed to intervene actively to vary the supply of currency notes and the ratio of bank cash reserves to bank deposits. This was in marked contrast to the Gold Standard where the central banks simply loosened credit when gold flowed in and tightened credit when gold flowed out. As yet, Keynes had little effect on public policy and Churchill, in an attempt to resume service as it was before 1914, returned Britain to the gold standard at the pre-war parity in April, 1925. Keynes wrote to The Times, "I hold that in modern conditions, wages in this country are, for various reasons, so rigid over short periods, that it is impracticable to adjust them to the ebb and flow of international gold-credit, and I would deliberately utilise fluctuations in the exchange as the shock-absorber." But Keynes's criticism of monetary policy and of the Conservative government never made him a socialist, never motivated him to want wealth redistribution. The Labour Party " is a class party and that class is not my class. If I am going to pursue sectional interests at all, I shall pursue my own ... the class war will find me on the side of the educated bourgeoisie." (p. 78) In the long run Keynes was a successful investor. But in late 1929 the commodity markets turned against him and his fortune fell from £44,000 (about $3.5 million dollars at present prices) to £7,815. He went back into Wall Street in 1932 and made money for both himself and his Cambridge college. October 1930 saw him publish his first major theoretical work, the two volume Treatise on Money. The book was particularly concerned with what Keynes saw as the misguided British attempt to return to the gold standard in the 1920s. He thought that the Bank of England, operating monetary policy to avoid gold reserve losses inflicted severe damage on domestic profits and employment, owing to the stickiness of certain prices, mainly labour. The stickiness might be due to the Trade Unions, institutional blockages to the labour market or mere psychological quirks. Whereas classical economists thought that these difficulties could be overcome by political action, Keynes believed that it was monetary policy which should adjust to what he considered the "natural tendencies of society" and "the earnings system as it actually is." (p. 80) Another prominent and controversial idea of the Treatise is that it is not to the thrift of our ancestors that we owe our present wealth and heritage of cultural monuments, but to the animal spirits of their more spendthrift and enterprising kin. "Were the seven wonders of the world built by thrift?" Keynes asks. "I deem it doubtful." And so does this reviewer. The pyramids were built by slave labour and the surplus extracted from the Egyptian population of the time. The London Olympic Games of 2012 were also not built by thrift. They were the result of taxes extracted from the British population at the time. But it's true to say that the economies of both the Egypt of the Pharaohs and the Britain of the 2012 Olympics, which provided the surplus to fund these great 'cultural monuments', were indeed built on the back of savings and thrift.

The London Olympic Games were not built by thrift.

In a lecture in Dublin in 1933, Keynes went even further against the mainstream. He recognised the "advantages of gradually bringing the producer and the consumer within the ambit of the same national, economic and financial organisation." (p. 87) In case there were some economists in the audience who had any fond regard for the benefits of the international division of labour and were wondering what they were hearing from an eminent Cambridge don, he rammed the point home. So "let goods be homespun whenever it is reasonably and conveniently possible and, above all, let finance be primarily national. " Oswald Mosely, to Keynes's embarrassment, sent him a letter of congratulation. As Steil dryly points out, Keynes did not take this new direction too much to heart. He continued his Wall Street purchases and by 1936, U.S. stocks made up 40 per cent of his personal portfolio.

Oswald Mosely, student of philosophy and keen admirer of Keynes.

By the mid-1930s, Keynes was preparing a revolution, and one which, for better or worse, would be remarkably successful. George Bernard Shaw had urged Keynes to take Marx more seriously. On New Year's Day 1935, Keynes replied that he was "writing a book on economic theory, which will largely revolutionise ‒ not, I suppose, at once but in the course of the next ten years ‒ the way the world thinks about economic problems." As for Marx, his economic value, "apart from occasional ... flashes of insight" is "nil." (p. 86) Keynes was right. In 1936 he published his most famous work, The General Theory of Employment, Interest and Money. Marx and Keynes both saw in capitalism the seeds of its own demise. But whereas Marx was pleased about this, Keynes believed that capitalism could ‒ and indeed should ‒ be saved by judicious government intervention. Within ten years, the world would indeed change the way it thought about economic problems. The ideas of The General Theory are well covered by Steil. Most revolutionary was Keynes's contention that the economy had no natural tendency to full employment. Classical economists held that protracted involuntary unemployment was the result of interference with the price mechanism. Keynes maintained that falling wages, if they lowered demand, could actually worsen unemployment. Classical economists believed in Say's Law, named after the great French economist. Keynes characterised this as 'supply creates its own demand' and set out to prove that it was false. I would define Say's Law as 'apt supply creates its own demand' or, supply the right sort of goods and services and the demand will be there. Say himself wrote, "a glut can take place only when there are too many means of production applied to one kind of product and not enough to another." (p. 90) Keynes believed that this was back to front. It was demand, not supply, which determined the level of economic activity and investment which called forth the requisite savings. Demand, as a result of psychological factors, could at any time be insufficient to ensure full employment. And this was the main controversy of The General Theory. Could a situation of persistent mass unemployment be described as being in 'equilibrium' as an economist would term it? Could mass unemployment persist if all prices were perfectly flexible? Plainly, if this were true, a slump could go on for ever unless the government stepped in. Was the Japanese malaise of the 1990s the result of the premature termination of fiscal stimulus, as the Keynesians believed, or was it the result of an excessive reliance on fiscal stimulus, as more classical economists believed. The debate has not yet been definitively resolved. Keynes also pointed out what he saw as another failing of modern capitalism. Investment, even given flexible prices, could fail to harmonise with savings. The problem was what Keynes called, 'liquidity preference,' or the idea that people might choose to hoard cash rather than consume or invest the fruits of their labour. This idea was a crucial part of Keynes's account of the monetary system but was strongly criticised by Keynes's French critic, Jacques Rueff. Rueff showed that the demand for "additional cash holdings" or what Keynes called "the propensity to hoard" had to be equivalent in its economic effects to demand for consumption goods or investment goods. Rueff's argument can be most easily grasped if we looked at a commodity-based monetary system such as the pre-1914 gold standard. In this system, the demand for money was necessarily equivalent to the demand for mining, moving and monetising gold. Yet the argument also held, Rueff maintained, in a fiat money system where the central bank issued cash in return for securities. These securities represented "wealth which is either stored up or, more generally, on its way through the process of production." (p. 92) To demand money is not to demand nothing, as Keynes implied, but to demand real wealth capable of being monetised within the framework of the existing monetary system. Rueff further argued that the end result of Keynsianism would be inflation and a private economy which would be less able to produce the goods that people wanted. This view became more widespread in the 1970s with the appearance of stagflation. Keynes's ideas suffered a setback during this period, but a revival followed the 2008 crisis, based on the notion that the 1936 work was a reliable tract on depression economics, if not in fact a 'general theory' that could be applied to boom times as well. I have dwelt on the chapter on Keynes to give the reader a sufficient flavour of this impressive book. You are not just given a straightforward journalistic account of the Bretton Woods conference and its protagonists. Benn Steil does cover this, but adds a clear and concise description of the monetary economics which is the crucial background. The Keynes chapter could be read as both a short biography and a lucid account of Keynesianism.

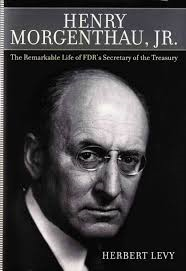

Harry Dexter White, represented the U.S. at Bretton Woods.

Harry Dexter White was everything that Keynes was not. He was born in 1892, the son of Lithuanian Jewish immigrants who had recently arrived in the U.S. A self-made man, he worked for the family's hardware stores after graduation. In 1917 when America declared war on Germany, White did not, like Keynes, register as a conscientious objector. Rather he enlisted in the army and served in France. Back in the U.S. White made the fateful decision to enrol at Stanford University and in 1924 he graduated "with great distinction" in economics. A series of academic and government appointments followed and White found himself attached to the U.S. treasury of Henry Morgenthau by 1934. But whereas Keynes moved almost effortlessly between Cambridge University and the British treasury, White had a series of precarious and temporary appointments at the American counterpart. Keynes was a talented writer and influential theoretician, White was a worker bee, a technocrat who impressed his boss by getting the job done. And whilst Keynes, a member of the educated elite, basically believed in capitalism (though it would need his genius to be saved), Harry Dexter White, the working class boy made good, was a Soviet spy. Steil tries to understand the motives for this by examining an essay that White wrote towards the end of World War Two. In it, White envisages a post-war world where U.S. financial global domination would be shared with a powerful Soviet Union and these two powers would keep the peace, ensuring there would be no resurgent Germany or Japan. White is at pains to point out that much of the criticism of the USSR was unjustified and clearly thought that it would be a prominent and successful economy after the war. He said, "Russia is the first instance of a socialist economy in action. And it works!" (p. 42) White also thought that the capitalist countries were moving in the direction of more state control of industry and competition and one wonders if he had read James Burnham's book, The Managerial Revolution, on that very subject. White definitely had read the work of the British socialist Harold Laski, Faith, Reason and Civilisation and believed that Laski had predicted the way the world was moving. "Since the October revolution," Laski pronounced, "more men and women have had more opportunities of self-fulfilment than anywhere else in the world." (p. 43) Sounding slightly bizarre today, one has to remember Laski was chairman of the British Labour Party in 1945, and that party was about to create the Soviet style National Health Service in 1948, a system which, amazingly, shows every indication of having a life span longer than the USSR. White believed he was passing information to a country which would be an ally of the U.S. after the war and a country which was pointing the way to the economic future of the world. How could that be either morally or practically wrong?

Harold Laski, influential socialist propagandist of the first half of the 20th century.

In any case, none of this was known or suspected at the U.S. treasury and by the time America entered the war, Harry Dexter White's relentless climb had landed him important responsibilities in the sphere of foreign policy. White was given the title of Assistant Secretary and Henry Morgenthau, the Secretary of the U.S. Treasury explained that "He will be in charge of all foreign affairs for me. I want it in one brain and I want it in Harry White's brain ..." As Steil observes, "Harry White was now one of the most powerful men in Washington." (p. 59) White also became the force behind the American preparation for the Bretton Woods conference. Keynes proposed a post-war system based around an international fiat currency called Bancor. White proposed the dollar as the basis of the world economic order after the end of the war. White explained the situation to other members of the American delegation. Gold in Fort Knox was "why the United States is in an enviable position ... why we are in a powerful position at this conference ... why we dominate practically the financial world, because we have the where-with-all to buy any currency we want. If only England was in that position, or any of the other countries, it would be a very different story." (p. 208) Desperate debtors, even those with emissaries as eloquent as Keynes could only bring words to bear ‒ words like 'adamant' and 'tranche', which amused Morgenthau no end. "We are learning a lot of new English words, aren't we?" he commented after reading a missive from the arch-prolific Keynes. (p. 208) The Christian Science Monitor even wondered why the conference was necessary at all. The average American did not need to be told that most of the world's gold was buried at Fort Knox. So when experts from other lands come to talk about money and loans, it gave simple folk the feeling that there might be thieves in the pantry. In fact, although the U.S. held most of the cards at Bretton Woods, the rest of the world had a fallback position: barter. In a press interview Keynes pointed out that "Great Britain might be forced to some very unacceptable means of pushing her foreign trade, should the monetary plan be rejected....The British, as two of their cabinet ministers recently asserted, may be 'broke'... but they are not without facilities for pushing their goods into foreign markets by means of bilateral trade agreements." (p. 209) Germany had been doing this for years, compelling foreign holders of marks to redeem them for German goods. Britain could do the same with the blocked Sterling balances of empire being made convertible into the wares which Britain chose to make available. Was Keynes being a little optimistic here? Lionel Robbins, a member of the British delegation at Bretton Woods, on July 2 recorded a special meeting between Keynes and the Indian delegation on the Sterling balance question. The New York Times reported that the Indian delegation caused a scene by demanding that the International Monetary Fund (created at the conference) provide some means of turning the UK's huge sterling debt into dollars. At nearly $12 billion, Britain's Indian debt alone was 50 per cent greater than the proposed capitalisation of the fund. Egypt then joined India demanding "some international magic to give their pounds the ability to purchase something that is wanted". (p. 218) Sterling was of little value as long as Britain's economy was on a war production footing and unable to supply creditors with something they really wanted.

Henry Morgenthau, author of plan to turn Germany into a pastoral paradise.

After Bretton Woods had been signed, White maintained that a commitment to restoring British prosperity threatened the financial and political power of the U.S. in the post-war world. But, if Britain was in trouble, this was nothing compared to what was being lined up for Germany. Morgenthau, ably backed by White, proposed in late 1944 a plan to de-industrialise Germany. Churchill, hunting for American money at the Quebec conference was an enthusiastic convert. But not everyone took such a vindictive or foolish approach. Anthony Eden was livid and wondered how Germany would pay for imports if it could not manufacture. Cordell Hull called the Morgenthau plan 'blind vengeance'. As details of the plan leaked out around the world, problems appeared. Goebbels declared it proof that the Anglo-Saxons, like the Bolsheviks, wanted to wipe out 30 to 40 million Germans. Thomas Dewey in the U.S. called news of the plan 'as good as ten fresh German divisions' and the near miraculous revitalisation of the Germany army at the end of 1944 showed he was not far wrong. Someone also pointed out that the Morgenthau plan by drastically weakening Germany would increase the strength of the USSR, a fact which could not have gone unnoticed by Harry White. The Morgenthau plan far exceeded the Versailles treaty in stupidity and there can be no doubt that its economic consequences would have been far worse than anything Keynes had envisaged in his criticism of the Versailles Treaty. Luckily, the plan was running into problems on many fronts and Roosevelt and Churchill started to retreat from what was a foreign policy disaster for the allies. The Bretton Woods agreement and the American loan had both to be ratified by the British parliament in December 1945. As the truth sank in that Britain had won the war but was thereby completely broke, the British politicians became more and more outraged. A conservative MP, David Eccles described Britain as a small nation "standing between the revised imperialism of Russia and the commercial aggression of America." (p. 284) He called the terms of the agreement " harsh and ... unworthy of two allies who have just saved the world by their exertions." But the dollars were indispensable and he would vote in favour. When Keynes spoke in the House of Lords, he agreed that Britain had made great sacrifices in the past, which had not been fully appreciated. Yet it was not "becoming in us to respond by showing our medals." The Americans found a post-mortem on the relative sacrifices of the allies distasteful and their attitude was practical and looking to the future. Keynes regretted that the American loan was not interest-free, but realised that a commercial loan would have been on worse terms. Beggars could not be choosers. The financial agreement was carried by a large margin in both Houses of Parliament. The British debt to the U.S. was ultimately repaid in full with a final instalment of $83.25 million in December 2006, under the government of Tony Blair. This was only the first of a number of bitter pills the British had to suffer in the immediate aftermath of their glorious victory. "The British Empire seems to be running off almost as fast as the American Loan," Churchill declaimed to the House of Commons in late 1946. "The haste is appalling." (p. 305) Keynes, dead in April of that year, had seen this coming. In February 1946, he wrote, "Take the case of Egypt. How do we propose to reply to the Egyptian demand that we should take our troops out of Egypt? Is it appreciated that we are paying the cost of keeping them there by borrowing it from Egypt? What is the answer if Egypt tells us (as, of course, she will) that she will no longer provide us with the necessary funds?" (p. 306) Keynes also saw that the American loan could not provide for the British population's material aspirations, encouraged by the Beveridge Plan, and the desire of the Whitehall politicians to cut a dash in the world. Keeping British forces in India would cost $500 million a year and the Middle East $300 million a year. This was a quarter of the American loan.

Clement Attlee, decided to end the British empire in February, 1947.

The winter of 1946-47 in the UK was the most brutal in living memory and it seems to have triggered a political collapse in Britain. Prime Minister Attlee signed an independence agreement with the Burmese General Aung San in January 1947. On 14th February, Bevin announced that Britain's Palestine mandate would be handed by to the U.N. On 18th February, the cabinet agreed to withdraw troops from Greece. On 20th February, Attlee announced that Britain would leave India. To many in 1946 and even some today, it was axiomatic that Britain gained economically from empire. Now it was clear that the empire was an unsustainable dollar drain and Britain did not have the economic muscle to bring truculent colonies like India into line. This took even the Americans by surprise. "There are only two powers left, " Dean Acheson observed in February 1947, referring to the United States and the Soviet Union. "The British are finished." (p. 309)

Dean Acheson, recognised in 1947 the British were on their way out.

Acheson was right. In September 1949, Britain devalued Sterling by 30 per cent. Now a pound would only buy $2.80, not $4.03. Keynes and White had debated for hours the role of the IMF when a country wanted to change its exchange rate. In the end, Britain gave the IMF twenty-four hours notice. In 1956, Britain took part in an attempt to prevent the Egyptian leader, Nasser, from nationalising the Suez Canal. America used its control of the IMF to deny the dollars the Britain needed to counter a run on Sterling and blocked UK efforts to secure emergency oil supplies. Britain was forced into a humiliating withdrawal. The following year, the Conservative government began the process which eventually resulted in the dissolution of the remainder of the British Empire. As the U.S. began to spend more on social programs and the Vietnam war, the dollar and the Bretton Woods system began to run into trouble. In the mid-1960s, De Gaulle said the world had had "no choice but to accept the international monetary system known as the 'gold-exchange standard' according to which the dollar was automatically regarded as the equivalent of gold." (p. 334) The U.S. was issuing dollars well in excess of its reserves and the De Gaulle ordered the Bank of France to demand 80 per cent of what the Americans owed in gold. In 1971, the French sent a battleship to bring home French gold from the New York Fed's vaults. On August 15th, 1971 President Nixon went on TV to announce that the gold window had been closed. The U.S. would no longer redeem foreign government dollar holdings with gold. The link between paper money and gold had been fraying since 1914. The dollar was the last link and Nixon had cut it. How do matters stand 70 years after Bretton Woods? Steil notes that the significant economic fact of the last 20 years has been the willingness of the Chinese to export goods to the U.S. in return for government debt. Dollars sent to China for merchandise came back as low interest loans. With no link to gold, there was no force to reverse the Chinese trade surpluses or U.S. deficits. By 2012, the Chinese had monetary reserves of $3.24 trillion, around 60 per cent of which are government securities. The U.S. has accumulated the world's largest international debt of $15.5 trillion. This is what Larry Summers has called, "a kind of balance of financial terror." The Chinese fear a collapse in the dollar, the Americans a collapse in foreign funding. Steil is a great pains to point out that the U.S. of today is hardly the supplicant Britain of the 1940s. Britain had been bankrupted by two world wars and needed dollars or gold to pay for imports. The U.S. still pays its bills in the currency it prints, a currency acceptable to the world. At the time of the Suez Crisis, U.S. government holdings of British securities amounted to $1 per resident. China's holding of U.S. securities today exceed $1,000 per resident. The U.S. in the 1940s and 1950s could provoke a Sterling crisis at little cost to itself; China cannot do the same. Sweet dreams indeed. Keynes once quoted the old saying, "Owe your banker £1000 and you are at his mercy; owe him £1 million and the position is reversed." At Bretton Woods, he found that this was not true and that the creditor eventually calls the shots. Do Summers and Steil really think the U.S. can escape this iron law of history?

|

|

.jpg)